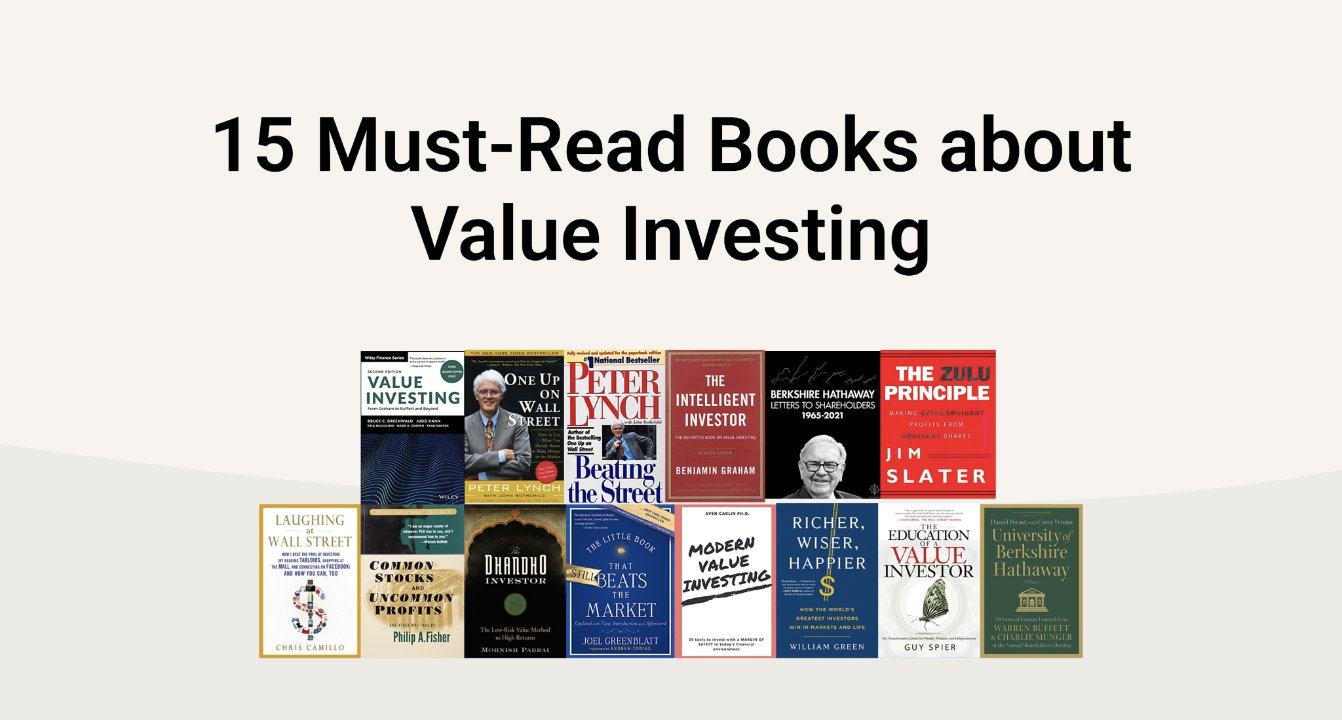

16 Must-Read Books about Value Investing

Here a personal overview of the 16 best Value Investing books I read and would recommend.

I read a lot of books to learn about Value Investing. Here's a list of the best books about Value Investing you need to read to become a great investor.

The Compounding Investor

The Compounding Investor introduces a systematic approach to finding businesses, then called Stacked Compounders, where multiple compounding effects stack: revenue growth, margin expansion, multiple expansion, and optionality working simultaneously.

The book covers an Optionality Framework to identify companies with "embedded options" the market ignores, explains why potential margins beat current margins, decodes ROIC, and includes real case studies like Microsoft's transformation under Satya Nadella and Meta's "Year of Efficiency".

Value Investing: From Graham to Buffett and Beyond

Value Investing: From Graham to Buffett and Beyond is probably the best and most complete book about Value Investing.

It is often considered the Bible of Value Investing, covering many important concepts and providing valuation tools that are more adapted to the modern investing landscape.

Beating the Street

Beating the Street is probably my favorite beginners book to learn about investing, and the one I would always choose to offer to anyone interested by investing.

Peter Lynch is great to teach what investing is and why anyone can become a better value investing than professionals on Wall Street.

He makes an important point that Wall Street is so disconnected from reality that retail investor have an edge just by knowing intimately the businesses they invest in.

One Up On Wall Street

Did you enjoy reading Beating the Street? Then, One Up On Wall Street should be the next book in your reading list.

While Beating the Street gives some general concepts, One Up On Wall Street is the practical use where Peter Lynch gives many examples of stocks he invested in and how he got outstanding returns.

The Intelligent Investor

The Intelligent Investor is probably one of the most important book about Value Investing. This is the book that Warren Buffet used to read as Benjamin Graham was his mentor. At one point, your must read this book if you are serious about learning Value Investing.

However, be conscious that it is not an easy read at all. Also, some things might seem a bit outdated but this books has gems in it, such as laying down the concept of Margin of Safety which is probably the most important concept of Value Investing (according to Warren Buffet and many other investors)

This edition has comments from Jason Zweig which gives more deepth and helps to understand The Intelligent Investor.

Berkshire Hathaway Letters to Shareholders

Reading past Berkshire Hathaway Letters to Shareholders written by Warren Buffet is probably one of the best way to understand how the father of Value Investing managed to consistently generate amazing returns during all these years.

Even though you can find most of Berkshire Hathaway's letters online on their website, those start from 1975 whereas the book has some interesting letters from 1965, and cost less than $3.

University of Berkshire Hathaway

University of Berkshire Hathaway is a 0.99$ book that is a compilation of notes from Berkshire Hathaway Shareholder's meetings during more than 30 years by the author.

It is a good complement to reading Shareholders Letters to get into the mind of Warren Buffet (and at this price, it's a no-brainer)

Richer, Wiser, Happier

Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life is a very interesting book in which William Green tells what he learned by interviewing more than 40 super-investors during 25 years.

Those super-investors include Sir John Templeton, Charlie Munger, Jack Bogle, Mohnish Pabrai or Joel Greenblatt. This helps us understand what are the qualities of great value investors.

Modern Value Investing

Modern Value Investing is a book written very recently by Sven Carlin, which is known for having one of the most interesting Value Investing Youtube channels.

He gives gives a list of 25 tools he is using in his approach to Value Investing, as well as his take on important concepts such as Margin of Safety, Moat, ...

The Little Book That Still Beats the Market

Joel Greenblatt is a well-known value investor that gives his advice in his book The Little Book That (Still) Beats the Market.

It is a very begineer-friendly book that exaplains investing in very simple terms, and is also famous for proving a Magic Formula that selects stocks that should beat the market.

The Dhandho Investor

In his book The Dhandho Investor, Monish Pabrai gives us some insights on his framework for value investing.

The Dhandho Investor exaplins what he learned from his "shameless copy" methodology by trying to replicate Warren Buffet and Charlie Munger's success in investing.

The Education of a Value Investor

The Education of a Value Investor is a book by Guy Spier, a well-known Value Investor and another disciple of Warren Buffet and Charlie Munger.

Guy Spier is also well known by being also a copier of Warren Buffet and Charlie Munger.

100-Baggers

Contrary to all the other books mentioned, 100-Baggers: Stocks that Return 100-to-1 and How to Find Them is not per se a Value Investing book, but it is a great read as it analyses all stocks that returned at least 100 times the initial investment.

Studying past high-performing stocks and trying to find common patterns is probably the best way to train your value investor's eye to spot the next 100-bagger!

Common Stocks and Uncommon Profits

Common Stocks and Uncommon Profits is not a recent book as the original edition is from 1958.

However, it is one of the first books about investing to become a bestseller and gives some interesting criterias on how to pick stocks that will outperform the market.

Laughing at Wall Street

Laughing at Wall Street is an interesting book because it gives quite a unique approach at value investing.

The author, Chris Camillo, explains how he tries to find companies that have an amazing product but negative sentiment. He also is very picky and invests very few times, but heavily when he does.

The Zulu Principle

The Zulu Principle is a simple and easy-to-read book about investing written by Jim Slater. He gives 11 selection criteria for picking winning stocks and "making extraordinary profits from ordinary shares"