The Ultimate Guide to Investing in Stocks for Beginners

How to invest in stocks for beginners. How to pick great stocks and find the best investments.

First, let’s start with a disclaimer: I am not a financial advisor and everything here is not investment advice, but a very simplified summary of what I learned about investing in stocks.

What is investing?

I avoided stocks for a long time, because in my mind it was a risky investment, only for speculators and traders. I'll try to describe what long-term investing (or value investing) is and why it is not as risky as we generally think. Investing is not day trading.

The difference between investing and speculating

Benjamin Graham gives a good definition in the first chapter of The Intelligent Investor "Investment versus Speculation" :

"An investment operation is one which, on thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative."

The main difference between investing and speculating is the level of risks involved, because investment requires a relative "safety of principal".

- Speculation will try to find very high-risk opportunities, with a high probability of loss but seeking higher returns.

- Investing takes another approach and prefers low-risk opportunities, but with a more certain probability of gain and a long-term horizon.

Investors consider the power of compounding. Compound interest has an exponential effect in the long run, but this strategy requires patience.

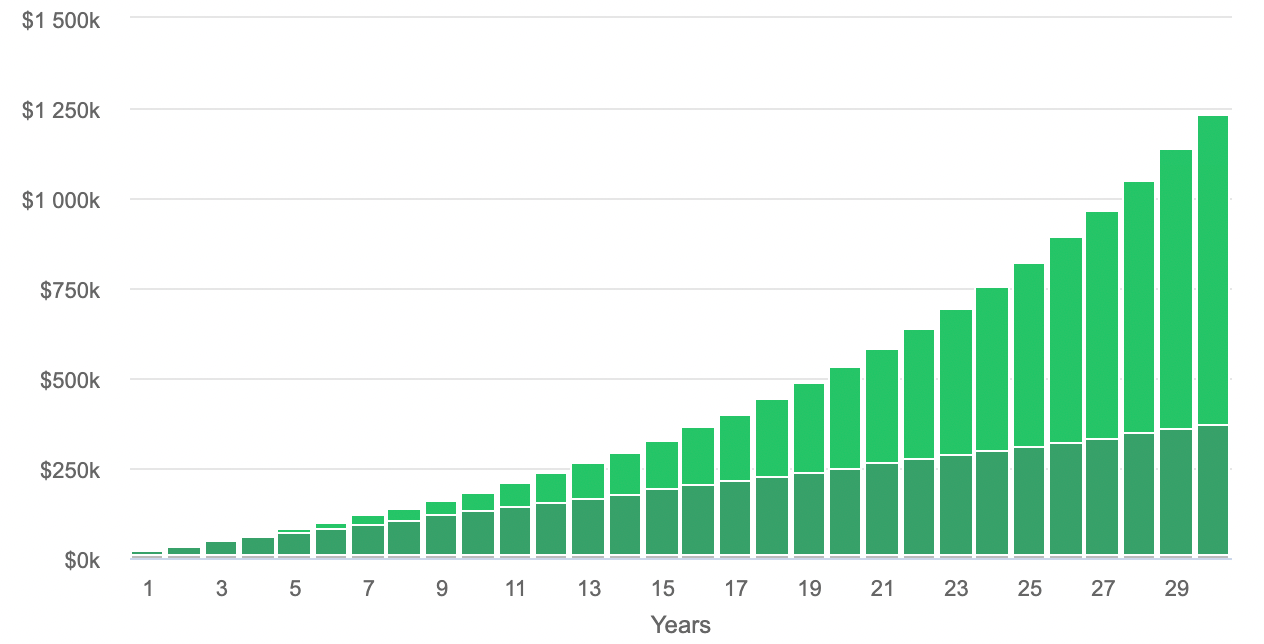

To better understand this compounding effect, here's a visualization of $1000 invested monthly and compounded during 30 years at a 7% interest rate:

The darker green is the principal (eg. the $1000 invested monthly) and the lighter green color is the interest. After 30 years, you would have approximately 1.2M$

You can notice that the interest takes a larger and larger proportion of the total amount. This powerful effect is sometimes referred to as the snowball effect.

The difference between investing and trading

The difference between investing and trading is the time horizon.

Generally, traders often open positions and close them by the end of the day. If the time horizon is between a few milliseconds (algorithmic trading) and a few weeks or months at most, then it is considered trading.

On the contrary, investing is a long-term strategy with a time horizon between a few months, and several years, or decades.

Passive investor vs active investor

An investor can choose different routes: he can either be a passive investor or an active investor.

- The passive investor will minimize its efforts, and try to get an average market return.

- The active investor, on the contrary, will try to outperform the market by actively managing his portfolio.

As Warren Buffet famously said, most people should be passive investors :

"Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund"

In the past 50 years, the S&P 500 had an annualized return of 7% (with dividends reinvested and adjusted for inflation. 11% without taking into account inflation)

Being an active investor and choosing stock-picking takes a lot of dedication, time, and effort, but can be very rewarding. These two strategies are not exclusive though, and if you want to start learning to be an active investor, you could try to allocate only a portion of your portfolio to stockpicking, and the rest to index funds to see how you perform after a few years.

How should I compose my portfolio?

Should I focus only on stocks?

We will mostly discuss stocks here but you need to understand that stocks are not the only possibility.

You also should consider other asset classes such as bonds, real estate, cryptocurrencies, commodities, ...

As an example, the All Weather Portfolio asset allocation is the following:

- 30% US stocks

- 40% long-term treasuries

- 15% intermediate-term treasuries

- 7.5% commodities, diversified

- 7.5% gold

Should I diversify? How many stocks should I hold?

General advice is often to diversify to reduce risk, but on the other hand, legendary value investors such as Warren Buffet or Charlie Munger agree that you cannot find 20 awesome companies. If you find only one, and you are very confident it is a great company, it should be a good portion of your stock portfolio.

Yes, it’s always better to have two or three companies than just one. If one printer is not working anymore, then you want to have other ones that work.

Diversification tends to reduce your divergence with the mean, and your performance will be closer to the average market return. Diversification is good for passive investors that want to get an average market return without too much trouble, but concentration is the best way to outperform the market for active investors that choose stockpicking.

What companies should I invest in?

How to choose a good company to invest in? The theoretical answer is relatively simple: you need to find a company with great value, at a good price.

Great investment opportunities have these two components:

- A great company (value): you want to have the best companies in the world (we will detail below what is a good company)

- A good price: you need to pay a low price for (we will see below how to know if a price is expensive or not)

If you get the best company in the world that everyone wants, but you pay a high price, it is more unlikely that you will be able to sell it at a higher price.

How to find great companies?

First, you need to think that investing in a stock is similar to buying a money printer. You should not care about what other people think of it. Maybe it is an ugly printer, but who cares?

What is important is the following :

- Some printers cost you even more money than they print when you operate them. You often need to avoid them like the plague.

- Is the money-printer printing a lot compared to what I paid for? (paying $1 a printer that prints $20 bills is better than the one printing $5 bills)

- How frequently is it printing money? Is it predictable or there are some fluctuations?

- Is the money-printer printing more and more money year after year?

- How long will the printer operate before it breaks?

If you transpose all of those questions to companies, you will focus on the important features of greatest companies:

- They have strong and growing revenues and earnings

- They have a strong competitive advantage and cannot be stopped or copied easily. This translates in high and growing margins.

- Their cash flows are growing year after year

- They reinvest the cash generated into the business to grow even more (think of using the printed cash to buy more of the same printer)

- They do even better than what they predicted

- They have little debt and some cash in hand to face any trouble

It seems simple in theory, but those perfect companies are very rare, and often very expensive when their qualities are obvious.

This is why you also need to find them at a good price:

How to evaluate what a company is worth?

There are two main ways to evaluate if a company is cheap or expensive:

Using valuation ratios multiples

The first method to have a valuation is using ratios such as the Price to earnings ratio (PE), Enterprise value to EBITDA (EV/EBITDA), Price to free cash flow (P/FCF), Price to growth ratio (PEG)...

These will give you an idea of how the company is valued relative to its peers. However, the main issue with ratios is that there are periods where all companies might be valued a lot more. If there is only a few great money printers, and everyone wants to buy them, they will be more expensive.

Discounted Cash Flows (DCF)

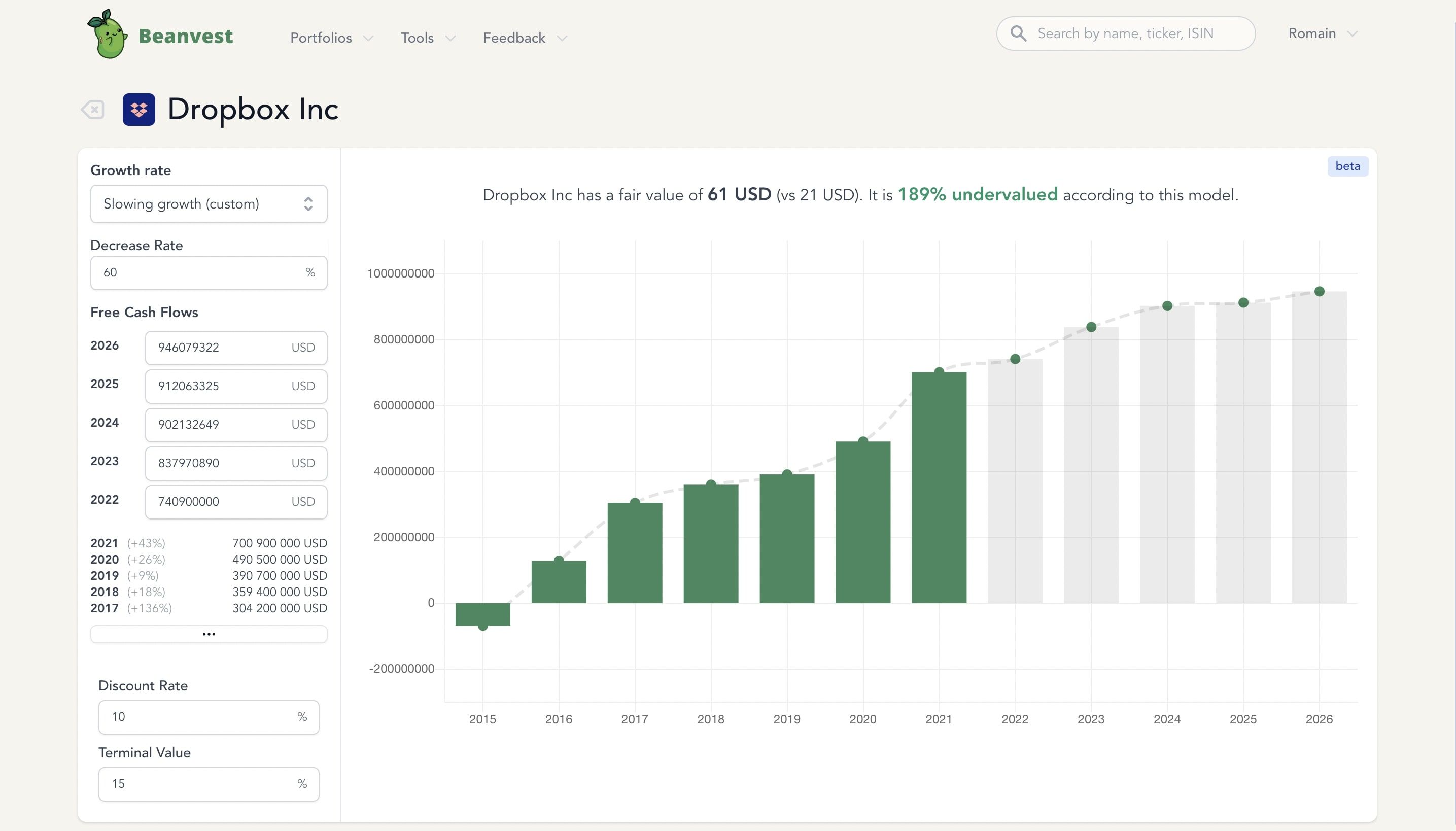

The second method is using Discounted Cash Flow trying to predict what the money printer will print in the future, and try to actualize the future cashflows. The difficulty of this method is that no one can predict the future.

Beanvest has a powerful Discounted Cash Flow calculator to help you do just that.

In any case, you should remind yourself that you do not want to speculate. You want to find companies with a very favorable risk-reward ratio: in the worst-case scenario, you don't lose any money, and in the best case you win a lot.

This is why is it often interesting to try finding hidden gems in unpopular companies. If you find a company with all the positive attributes mentioned previously, but the company is not known or very unpopular, it might be a good sign.