You will not get Rich with stocks - 4 secrets from Warren Buffet

Here are 4 secrets Warren Buffet used to grow his wealth. Without them, you will never get rich with stocks

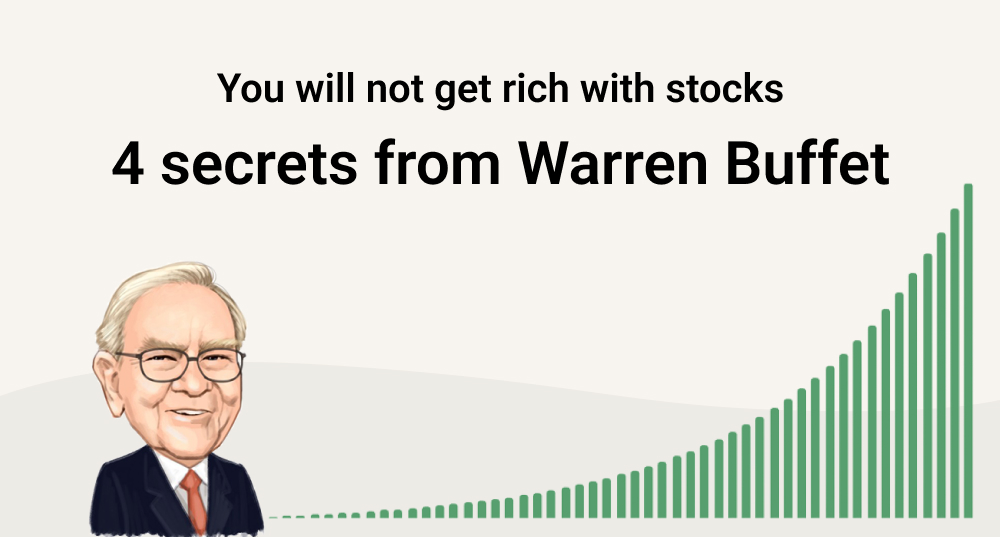

Imagine you can get a yearly return of 8% and decide you can invest 100$ per month starting from 30 years old.

It will take you 53 years to become a milionnaire and you will be 83 years old... Depressing right?

So how did Warren Buffet do it? Here are the 4 secrets behind his wealth.

1. Start investing early, and do it over a long period

As you might already know, compounding has an exponential effect that you can see really in the long term. Investing 40 or 50 years makes a huge difference.

Warren Buffet is now old, and started really early. The compounding period is on of the secret, but requires a lot of patience. This is the slow way of becoming rich.

Let's say that instead of starting at 30 years old, you started at 15 years old. Instead of having 1 million at 83 years old, you would now have 3 millions!

It is really hard to understand how exponential is compouding, and how dramatic the effect can be over a long period of time, but if you invest during 50 years, the last 10 years will earn more than the first 40 years!

Therefore, patience is key. And if you have not started investing yet, the best time to do it is now.

2. Have a concentrated portfolio of outstanding companies

Warren Buffet famously said that investing in stocks should be like a punch card. Imagine you could only invest in 10 companies in your whole lifetime.

Actually, stockpicking is not about picking stocks, but excluding stocks and being really picky. You need to pick stocks that have a potential huge upside, and almost no possible downside.

You don't understand the business? Pass.

As you will not find such outstanding companies all the time, you need to bet big when the opportunity presents to you. However, most of the time you will be doing nothing, which requires a lot of patience and self-discipline.

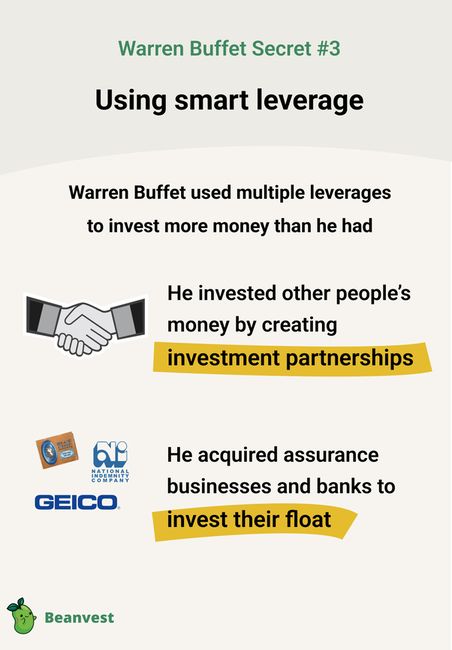

3. Invest more by using other people's money

While using margin can be really dangerous as you can be margin called, there are some other ways to invest more money than you can by yourself.

The first secret of Warren Buffet is starting with buying insurances companies and banks. The good thing about insurance companies is that they have float : this means that between the time customers pay for insurance, and the time the insurance must pay premiums, this cash can be invested by Warren Buffet to generate returns.

The second secret to having more money to invest is to invest other's people money. By having a good track record in his first years, Warren Buffet was able to create investment partnerships and attract other people's money

4. Never take money out, reinvest dividends

As previously said, value investing is all about making un frequent but big bets. Investors should also be careful bout selling. Selling should never be done to take money out, but only when the businesses you own are way overvalued. One of the main reasons is that selling will often be a tax eligible event. So would you prefer to pay taxes, or keep this money compounding even in a slightly overvalued company?

The same reasoning should be applied for dividends. They should be reinvesting in companies to make sure the money keeps compounding.