Cash Flow Statement

What is a Cash Flow Statement?

A cash flow statement is a financial statement that outlines the cash inflows and outflows of a business over a given period of time. It is presented alongside the income statement and balance sheet as one of the three core financial statements. The cash flow statement provides a clear picture of how cash moves through the company, offering key insights into its financial health and liquidity.

Unlike the income statement, which includes non-cash items like depreciation and amortization, the cash flow statement focuses exclusively on actual cash transactions. This makes it an essential tool for understanding whether a company can fund its operations, pay its debts, and invest in future growth.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

Operating activities reflect the cash generated or spent through the company's core business operations. This section typically provides the clearest indication of day-to-day business performance.

Cash inflows from operating activities include:

- Cash received from customers for goods or services

- Interest and dividends received

- Other operating receipts

Cash outflows from operating activities include:

- Payments to suppliers and employees

- Interest paid on debt

- Income taxes paid

- Other operating expenses

Operating cash flow is widely considered the most important section because it shows whether the company's core business generates enough cash to sustain itself without relying on external financing.

Investing Activities

Investing activities relate to the purchase and sale of long-term assets and investments. This section helps investors understand what capital allocation decisions management is making.

Cash inflows from investing activities include:

- Proceeds from selling property, plant, and equipment

- Proceeds from selling investments or subsidiaries

Cash outflows from investing activities include:

- Purchases of property, plant, and equipment (capital expenditures)

- Acquisitions of other businesses

- Purchases of investment securities

Subtracting capital expenditures from operating cash flow yields free cash flow, one of the most important metrics for evaluating a company's financial strength and intrinsic value.

Financing Activities

Financing activities encompass all cash flows related to funding the business through debt and equity. This section tracks how the company finances its operations and returns value to shareholders.

Cash inflows from financing activities include:

- Proceeds from issuing bonds or taking on loans

- Proceeds from issuing new shares

Cash outflows from financing activities include:

How to Analyze a Cash Flow Statement

When reviewing a cash flow statement, investors should focus on these key areas:

- Operating cash flow trend — Is operating cash flow growing over time? Consistent growth is a sign of a healthy, expanding business.

- Cash flow vs. net income — Compare operating cash flow to net income. If net income consistently exceeds operating cash flow, it may indicate aggressive accounting or deteriorating cash generation.

- Free cash flow — Calculate free cash flow (operating cash flow minus capital expenditures) to assess how much cash is truly available after maintaining the business.

- Capital allocation — Examine how management deploys cash. Are they investing in growth, paying down debt, returning cash to shareholders via dividends, or a combination?

- Cash position — Track the net change in cash over time to ensure the company maintains adequate liquidity.

Cash Flow Statement vs. Other Financial Statements

| Feature | Cash Flow Statement | Income Statement | Balance Sheet |

|---|---|---|---|

| Time frame | Period of time | Period of time | Point in time |

| Measures | Actual cash movement | Revenue, expenses, profit | Assets, liabilities, equity |

| Includes non-cash items | No | Yes (depreciation, amortization) | Yes (goodwill, intangibles) |

| Key metric | Free cash flow | Net income | Total assets / equity |

All three statements are interconnected. Net income flows from the income statement into retained earnings on the balance sheet, while changes in balance sheet items are reflected in the cash flow statement.

What is a Good Cash Flow?

A company with strong cash flow characteristics generally exhibits:

- Positive operating cash flow that exceeds net income, indicating high-quality earnings.

- Consistent free cash flow generation, enabling the company to grow, pay dividends, or reduce debt without external financing.

- Low reliance on financing activities for day-to-day operations.

- Strategic capital expenditures that support long-term growth without excessive spending.

Conversely, persistent negative operating cash flow, especially in a mature company, is a red flag that may signal financial trouble.

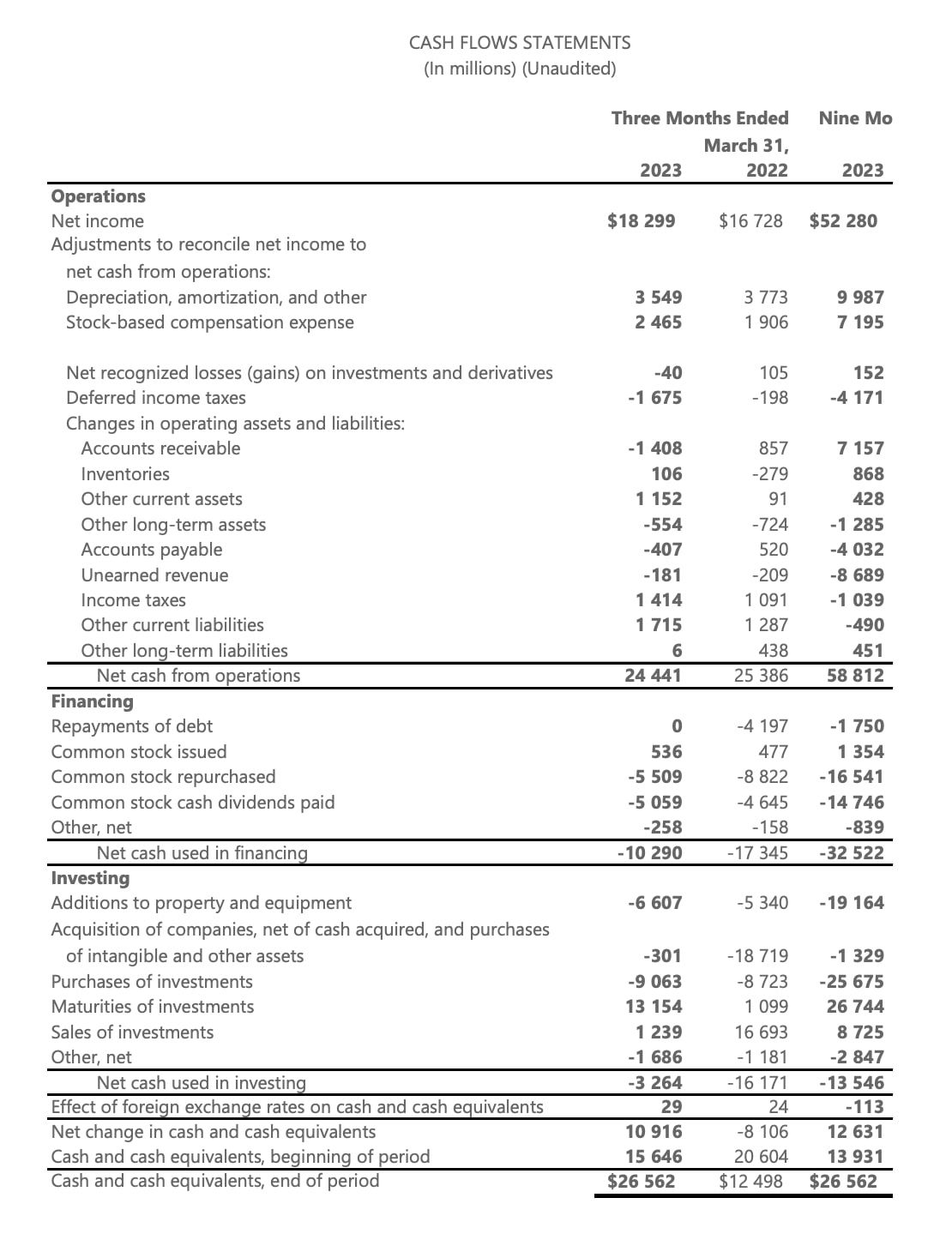

Example: Microsoft Cash Flow Statement

For a more concrete example, here is a cash flow statement from Microsoft:

The Bottom Line

The cash flow statement is arguably the most important of the three core financial statements because it reveals the true cash-generating ability of a business. While profits can be manipulated through accounting assumptions, cash flow is much harder to distort. Investors who understand how to read and analyze cash flow statements are better equipped to identify companies with genuine financial strength and avoid those with deteriorating fundamentals.