Magic Formula

What is the Magic Formula?

The Magic Formula is a system developed by Joel Greenblatt to select stocks that have a good chance of providing market-beating returns. It's a value investing system, mentionned in his book The Little Book That Still Beats the Market, where you select stocks based on their current fundamentals (price, earnings, book value, etc.) as well as their past performance (dividends, share buybacks, etc.). The Magic Formula is based on the principles of Benjamin Graham, one of the founding fathers of value investing.

The main idea of the Magic Formula is to identify stocks that are trading at bargain prices—those that are relatively cheap (when compared to other stocks in the same sector) but still have strong long-term growth potential. To do this, the Magic Formula ranks stocks based on two quantitative metrics:

- Earnings Yield is a measure of how much cash a company generates relative to its share price. The higher the earnings yield, the cheaper the stock is relative to its peers.

- Return on Capital (ROC) is a measure of how efficiently a company uses its capital. The higher the ROC, the better a company is at turning capital into profits.

The Magic Formula then takes these two metrics and looks for stocks that have both a high earnings yield and high ROC. Stocks that meet these criteria are the most likely to beat the market.

Is the Greenblatt's Magic Formula working?

There are also other studies and evidence that demonstrate the continuance of success of the Magic Formula. Here's an overview of some of the most recent research that's been conducted to test if the Magic Formula is still working:

The answer from these studies seem to be Yes, the Magic Formula is still working and can still be a valuable tool for value investors.

The results from all these studies showed that the Magic Formula is able to provide an outperformance compared to the market, and this has been validated across very different markets (Nordic markets, Indian stock exchange, ...). However, it should be noted that the results may vary depending on the region, period and number of stocks included in the portfolio.

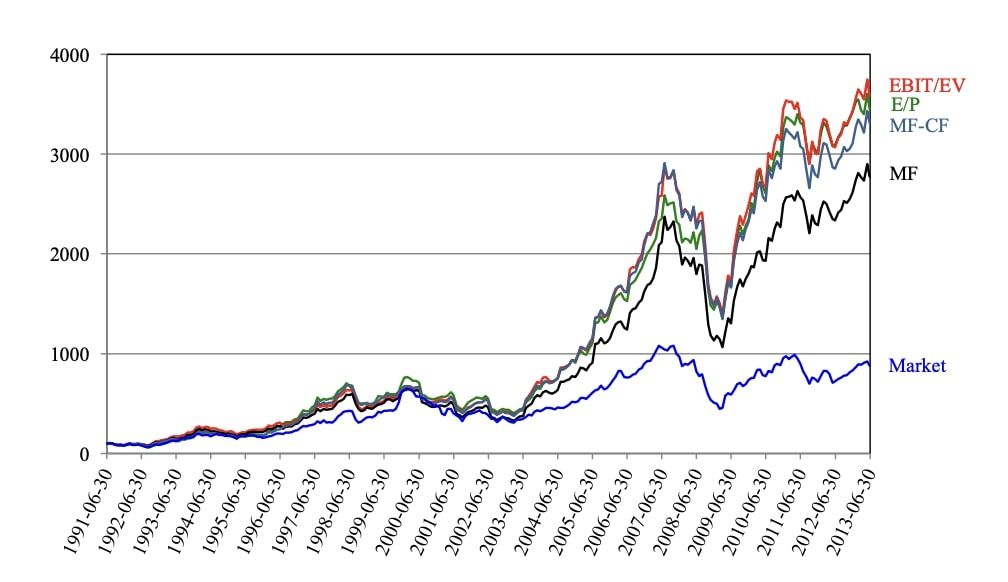

Here's an overview for the Magic Formula (MF) return vs the market, and also compared with some modified Magic Formulas (source: Magic Formula vs. Traditional Value Investment Strategies) :

How to use the Magic Formula?

The Magic Formula itself is relatively simple and straightforward. First, you must rank stocks based on their earnings yield and ROC. To do this, find the stocks' current earnings per share (EPS) and the company's market capitalization. You can then calculate the stock's earnings yield by dividing the EPS by the market capitalization. Joel Greenblatt even provided a website with a screen and ranking system to help investors find stocks that meet the criteria.

Once you have your list of stocks, you can narrow it down further to stocks with strong fundamentals (profitability, dividend yield, etc.) and a good track record (share repurchases, etc.). A quick look at the past and current performance of the stocks on the list will help you pick out those that have a good chance of outperforming the market. Once you've selected the stocks you wish to invest in, make sure you keep an eye on them in the long term.